Will Blockchain Make Banks Obsolete?

6 min read

08 Jan 2025

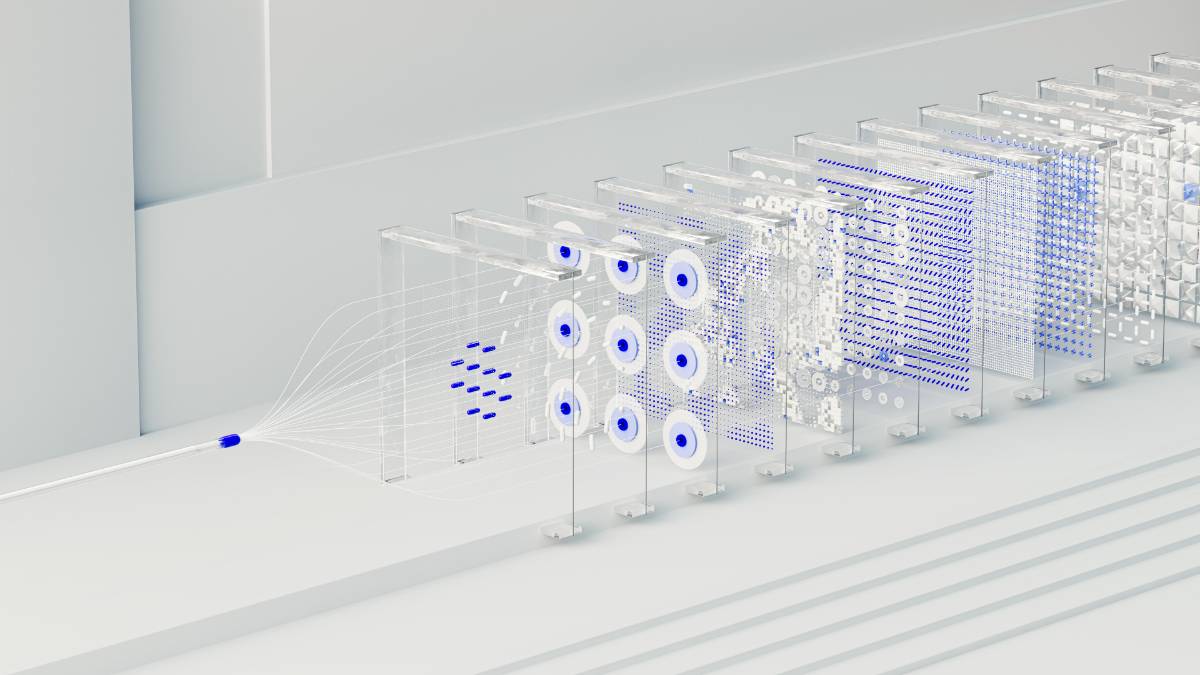

Blockchain technology has sparked debates about its potential to disrupt traditional banking systems.

Decentralization and Trust

Blockchain's decentralized nature challenges the centralized model of traditional banks, offering enhanced security and transparency.

Payments and Transactions

Blockchain enables faster and cheaper cross-border payments and transactions, reducing reliance on traditional banking intermediaries.

Financial Inclusion and Accessibility

Decentralized finance (DeFi) platforms provide access to financial services for underserved populations without traditional banking infrastructure.

Regulatory Challenges

Regulatory compliance and integration with existing financial systems present hurdles for blockchain adoption in banking.

Collaboration vs. Disruption

Some banks explore blockchain for efficiency gains, while others see it as a disruptive force threatening their business models.

Future Scenarios

The future role of banks may evolve as blockchain matures, with potential partnerships and innovations shaping the financial landscape.

Conclusion

While blockchain poses challenges to traditional banking, its impact will likely involve a complex interplay of disruption and collaboration in the financial sector.

More Articles

The Role of AI in Climate Change Mitigation and Adaptation

4 min read | 31 Dec 2024

How Machine Learning is Transforming Healthcare: Innovations and Challenges

7 min read | 30 Dec 2024

The Evolution of Artificial Intelligence: From Early Concepts to Modern Applications

7 min read | 29 Dec 2024

AI & ML in Wildlife Conservation: Protecting Endangered Species

4 min read | 28 Dec 2024

More Articles

Machine Learning Algorithms: An Overview of Popular Techniques and Their Applications

7 min read | 10 Jan 2025

AI and the Creative Arts: Exploring Machine Generated Music and Art

4 min read | 09 Jan 2025

AI in Education: Personalized Learning and Intelligent Tutoring Systems

4 min read | 08 Jan 2025

The Impact of AI on Employment: Job Displacement vs. Job Creation

4 min read | 07 Jan 2025